A few tips from Linda:

* Be cautious when looking into a “Lease Option” opportunity if one presents itself. For the Seller, it most always means that the bank can, at any time, call for all monies owing from you on the property per your mortgage’s “Due On Sale” clause, as you are technically transferring a form of ownership in an Option. I.e., you could be called upon to pay in full. Contrary to popular belief, setting up a Trust does not get you around the Due On Sale clause either. Best to consult with your Realtor, and/or attorney before embarking on an adventure like this : )

* Remember that all repairs agreed to in a transaction in the State of Oregon must be performed by a licensed, bonded contractor.

* Make sure to give your Lender plenty of time to “close” your transaction when writing your offer. Talk to your Realtor, and make sure to consult with your Lender to see about how long they need. Lately it is typically around 45 days, but each situation is different. Should you not meet your “on or before” closing date as per your Offer contract, the Seller could possibly accept another offer and keep your earnest money… just sayin’ : ) Now, most people will compromise and agree to an addendum extending the closing date, but you cannot guarantee that the Seller will agree to that… If they have, let’s say, received a better verbal offer than yours during the time it has taken to get from agreement to “not meeting” the closing date, they may just decide to opt to take that larger offer. Just a note of caution.

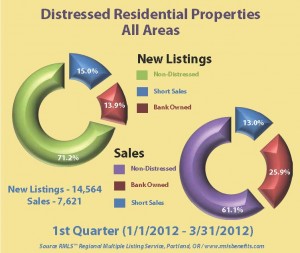

Let’s take a look at the recently released data on real estate for 2012.

Below is some information for you on the overall Portland area, as well as specific Lake Oswego/West Linn (RMLS lumps them together) activity:

According to the RMLS Market Action Report for the Portland Metro Area December, 2012. At 1,760, closed sales were 9.2% higher than December 2011 sales of 1,612. pending sales (or “Accepted Offers”) were down, however, with 1443 in December of 2011, and 1384 in December 2012… putting the market down by 4.1%.

- 2012 racked up 32,300 new listings, 24,010 accepted offers, and 23,438 closed sales.

- Compared to 2011, new listings are down 5.2%, pending sales are up by 16.2% overall, and closed sales are up 19.1%.

- The average sale price in 2012 was $275,000, which is 4.4% higher than 2011’s $263,300.

- ***AND… Total time on the market has dropped by 21.5% from 143 to 112 days.

- The overall economic improvement and increase in volume has positively affected the numbers for total dollar volume which rose to $6.45 billion in 2012 from 2011’s $5.2 billion.

- For our Property Blotter readers, the combined area of Lake Oswego and West Linn reported the following totals for 2012:

- 2085 New Listings (68 in Dec’12)

- 1389 Pending Sales (81 in Dec’12)

- 1364 Closed Sales (108 in Dec’12)

- An Average Sale Price of $434,800. ($512,100 in Dec’12!!)

- Prices rose 1.5% in 2012 over 2011’s totals

![Terra+002[1]](https://www.propertyblotter.com/wp-content/uploads/Terra+0021-300x236.jpg)