So when the State Legislature passed a law in 2009 that affects woodstoves, I was very interested. This law, known as the Heat Smart for Clean Air Act, went into affect August 1, 2010. It requires the removal of non-certified woodstoves and fireplace inserts upon the sale of a house.

This law does not require the removal if a house is not sold. So you can continue to use and enjoy your non-certified stoves as long as you continue to own your home. It is only upon the sale of the house that they must be removed.

This law also applies to stoves and inserts that are in garages, shops, and out buildings.

Once the stove/insert is removed it can not be sold, given away or re-installed. In fact, it must be destroyed/recycled and evidence of this must be provided to the Oregon DEQ.

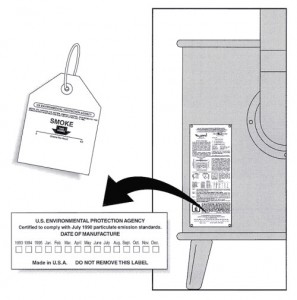

How do you know if your stove/insert is certified? There are 3 ways:

1. The Federal DEQ has been certifying stoves since 1992 and a stove sold after that year will have a Federal certification sticker on the stove.

2. The Oregon DEQ has actually been ahead of the Federal government on this and has been certifying stoves since the mid 1980’s. So, again, you’ll find an Oregon DEQ sticker on the stove.

3. A list of certified stoves by brands and models is maintained on line. Click here for that list.

Who’s responsible for removing the woodstove/insert? That is negotiable between the buyer and the seller. Either party can do it, but it has to be completed within 30 days of the sale. And be aware that many lenders would require it’s removal prior to the sale.

Does the woodstove/insert have to be replaced? No. Many older models were quite large. So removing them may benefit the house.

If you do replace it, the models made today are amazing and consist of pellet stoves, wood stoves, and masonry heaters. They are high efficiency with low emmissions. I have a client who heats his house with a pellet stove that he calculates saves him hundreds of dollars each winter.

Finding the certification sticker on your woodstove is easy. It should be on the back of the stove. Finding it on your insert can be tricky as you will have to pull the insert out of the fireplace opening to look for it. Try finding the insert on the approved list first. That could save you the work of pulling the insert out.

If you don’t find your make and model on the approved list, consider inquiring with a chimney sweep or the service department of a hearth product store. For a locator of these sorts of companies, click here.

Can you retrofit an old stove so that it can be certified today? No.

Why did this new law go into affect? The pollution caused by old stoves creates serious negative air quality that causes health problems, especially for older people and young children. It’s estimated that for every old stove removed, the savings in health care costs will be $3900. These old stoves can last decades. This law will speed up the process of removing and replacing these stoves. It is also believed that there are 80,000 uncertified woodstoves and fireplace inserts still in use in Oregon.

In addition, there are both State and Federal tax credits for installing new stoves. My understanding is that Oregon gives a credit of $300 and the Federal government is giving a credit of $1500. Please confirm these figures with your own inquiry or through your tax accountant.

Information for this post was obtained at www.ohpba.org/oregonlaws.htm

Good luck building your own one-match fire!

Dianne